straight life annuity payout

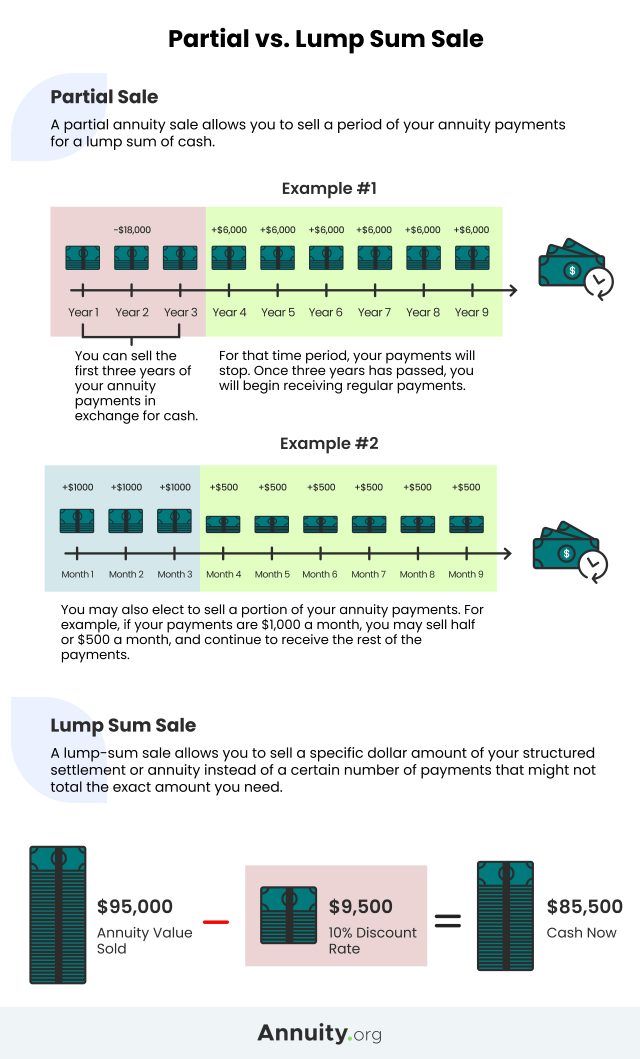

Without the period certain option income benefits will be. For example if you purchase a single-life annuity with a 20-year period certain and pass away 10 years later your beneficiary will collect income benefits for another 10 years.

Straight Life Annuity Definition

Term life insurance or term insurance is one of the life insurance products that offer coverage for a specified term usually for a limited time period the applicable term.

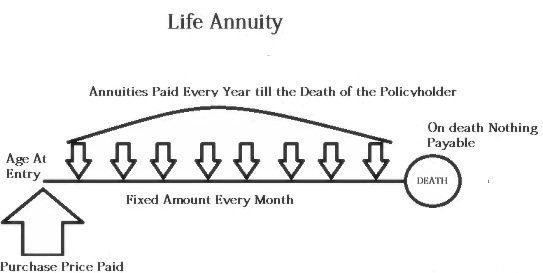

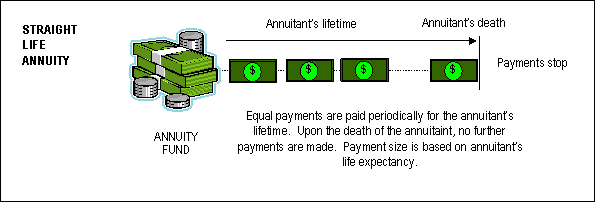

. These payments are guaranteed to last for life or a. The cash value is now guaranteed. Life insurance policies are generally purchased to provide coverage for an unforeseen unfortunate event like the insured persons death.

If you have a joint life insurance policy where one of you will receive any life insurance payout if your partner dies our Survivor Trust may suit you. Immediate annuities are long-term tax-deferred contracts you purchase from an insurance company that provide immediate regular payments in exchange for a lump-sum investment. Term insurance provides financial security and protection for the family.

A fixed annuity sets a guaranteed payout for the rest of the beneficiarys life. What are the different ways you can take income from an immediate annuity. Calculate the total dividend paid out to the shareholders of Apple Inc.

The net profit margin of the company remained healthy at 2241 and it decided to pay out 2284 of the net earnings to the shareholders in the form of dividends. Immediate annuities limitations and restrictions. The company clocked net sales of 265595 million during the year ending on September 29 2018.

Let us take the real-life example of Apple Inc. Likewise if your annuity payout is not adjusted for inflation it is unlikely to keep pace with your expenses given long-term historical average inflation rates of just over 3. The graduated payments begin at 181 of the jackpot amount and rise exponentially such that the final payout is 556 more than triple that.

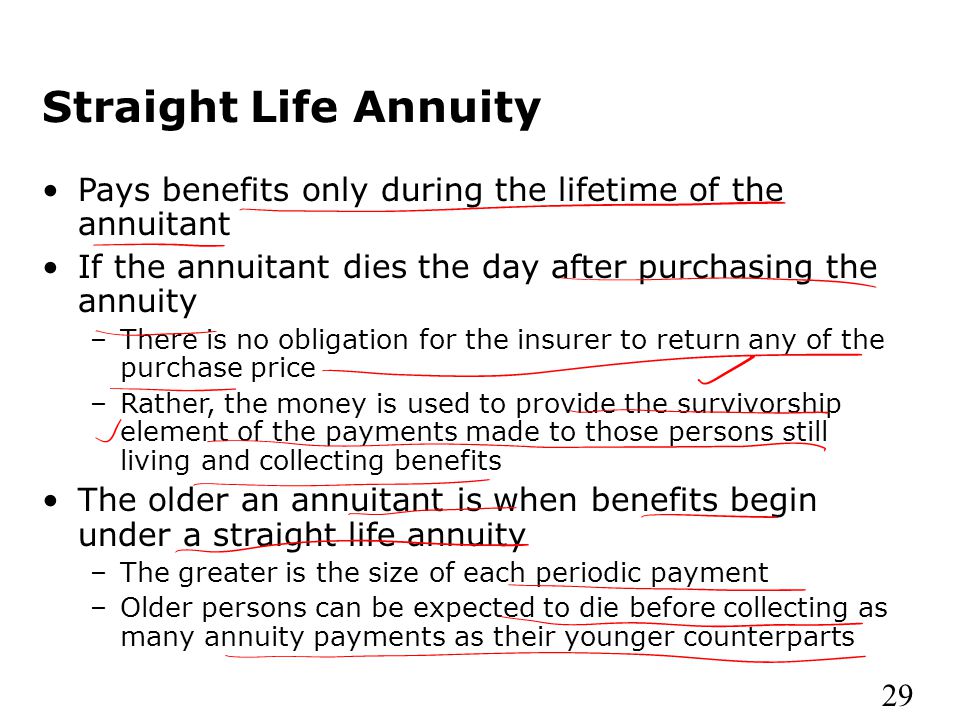

As of the May 11 2013 drawing the advertised annuity jackpot represents a 30-payment graduated annuity stream similar to that of Mega Millions partly in response to low long-term interest rates. Fixed annuities can provide predictability and a steady income during retirement. A life annuity with period certain is a hybrid option that provides lifetime payments with guaranteed income for a specified number of years.

By placing your policy in the Aviva Survivor Trust the trustees can pay any money to the surviving partner as long as theyre still alive 31 days after the death of their partner. USAAs Single Premium Immediate Annuity SPIA took the title of the best straight life annuity with its blend of low fees immediate payment financial stability and a plethora of program options.

When Can You Cash Out An Annuity Getting Money From An Annuity

What Is A Straight Life Annuity Everything You Need To Know

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

The Pros And Cons Of Joint Life Annuities Trusted Choice

Annuity Payout Options Immediate Vs Deferred Annuities

Period Certain Annuity What It Is Benefits And Drawbacks

What Are Your Annuity Payout Options Due

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Annuity Payout Options Immediate Vs Deferred Annuities

What Is A Straight Life Annuity Everything You Need To Know

Annuities And Individual Retirement Accounts Ppt Video Online Download

What Is A Straight Life Annuity Retirement Watch

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

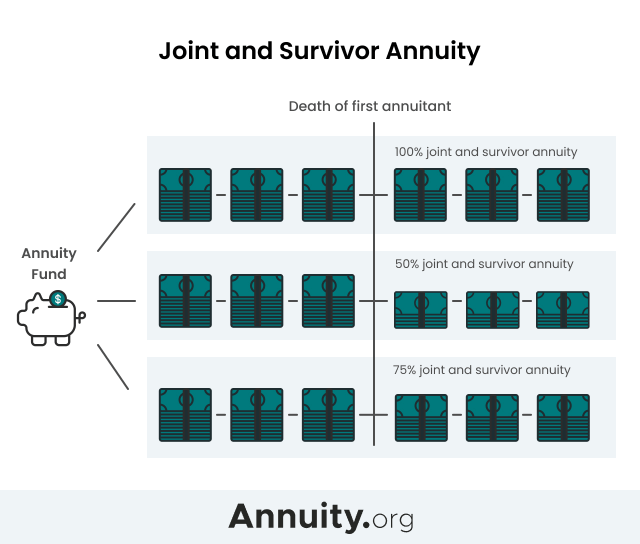

Joint And Survivor Annuity The Benefits And Disadvantages